NuORDER Announces $45M Funding

March 11, 2021

Leading B2B commerce platform’s latest investment round signals fast-changing wholesale and retail landscape

LOS ANGELES, CA – NuORDER, the leading B2B e-commerce platform announces it has raised $45 million in a round led by Brighton Park Capital and Imaginary Ventures. The funding is a testament to the acceleration of digital buying and selling over the past twelve months and signals future growth opportunities that exist within the multi-trillion dollar B2B market.

This phase of investment will support NuORDER’s continued growth and expansion within focus markets and enable the company to claim and transform commerce, finance, payments, data and discovery between brands and retailers within the global B2B marketplace.

Natalie Massenet, Co-Founder and Managing Partner of Imaginary Ventures and Founder of Net-A-Porter, will join as a board member and strategic partner driving European expansion and growth of the fashion and luxury retail markets. Managing Partner Mark Dzialga of Brighton Park Capital will also assume a seat on the board and contribute his expertise in helping companies execute against their global ambitions and within payments and marketplace.

“I have seen first hand how slowly the fashion and retail industry adapts to change without a tipping point, and this past year has been another critical inflection point for many,” said Natalie Massenet, Co-Founder and Managing Partner of Imaginary Ventures. “There has been much focus over the last few decades on the consumer end of retail, but little advancement in the ways the industry operates behind the scenes. NuORDER has built the much-needed technology to power wholesale, buying, merchandising and now payments, providing businesses with digital tools to work efficiently and profitably in a rapidly changing consumer and retail landscape. Imaginary Ventures is proud to back NuORDER and I am delighted to join the board of directors to help guide the company as it enters into this next phase of growth.”

“NuORDER has digitally transformed the wholesale buying and selling process for leading global brands and retailers,” said Mark Dzialga, CEO and Managing Partner of Brighton Park. “As the consumer landscape continues to evolve, this investment reflects Brighton Park’s strong belief in NuORDER’s talented team, and differentiated platform revolutionizing retail merchandising, payments, and visualization. We look forward to leveraging our investment expertise to support the company’s long-term growth and success.”

Since 2011, NuORDER has been solving real problems faced by the fashion, luxury, footwear, outdoor and sports industries. Through cutting edge technology and digital market tools including Virtual Showroom and a newly launched Payments offering, the company remains focused on creating greater efficiencies and revenue for its clients and the industry at large. Over the past twelve months, NuORDER has seen 125% growth driven by the effects of the pandemic and the need for businesses to digitize and streamline their processes, with 30% of GMV coming from Europe. Leading retailers including Saks Fifth Avenue, Nordstrom and Bloomingdale’s conduct all of their buying and selling through NuORDER exclusively. This recent round of investment puts NuORDER on the path to setting a new standard for B2B commerce and driving innovation within the global marketplace.

“It’s a pivotal time for the industry and more important than ever for NuORDER to deliver innovation to brands and retailers globally to help them succeed. The new capital allows us to accelerate our vision with key investments in product and engineering and we feel fortunate to have such a great set of partners championing and supporting our growth,” said Olivia Skuza, Co-Founder and Co-CEO of NuORDER. “At a time when the B2B commerce landscape is evolving rapidly, we remain focused and are in a position to execute on our core mission of setting the global standard for commerce, discovery and payments and delivering the industry with a best in class solution through a single platform,” added Heath Wells, Co-Founder and Co-CEO of NuORDER.

For more information, please visit www.nuorder.com.

###

About NuORDER

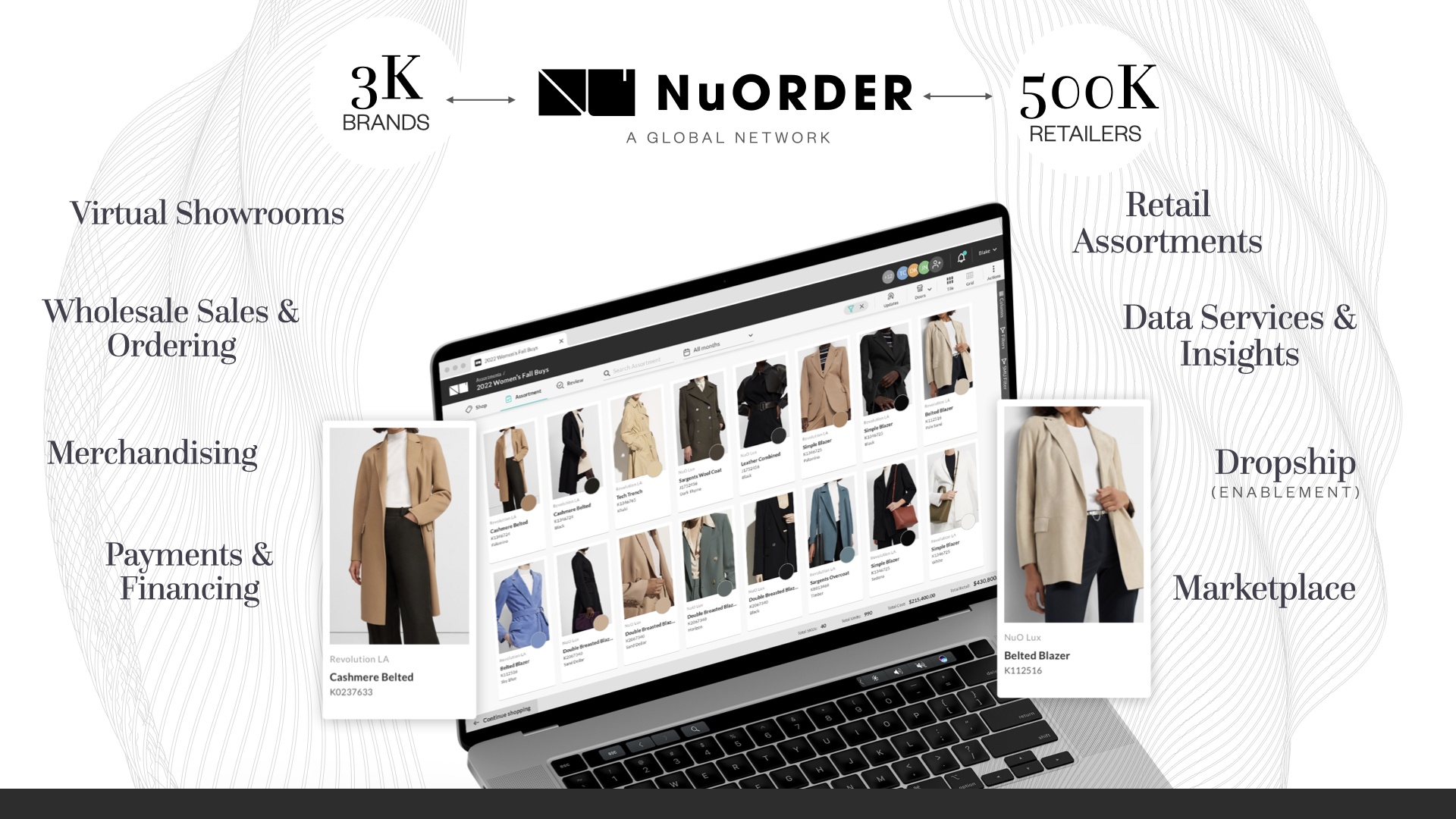

NuORDER is the leading B2B platform powering commerce and discovery. With innovative technology and data driving processes at its core, the platform creates greater efficiencies and a seamless and more collaborative buying and selling process for the world’s leading brands and retailers. NuORDER delivers a global commerce solution offering Virtual Showroom technology, visual assortment and merchandising tools, payments and data integration. Connecting more than 3,000 brands and more than 500,000 retailers, the platform has become a global ecosystem driving discovery and marketplace. The platform was engineered with flexibility and scale in mind, processing over $40B in GMV. It empowers businesses of all sizes with enterprise-level technology on a global scale. Founded in 2011 by Heath Wells and Olivia Skuza, NuORDER is headquartered in Los Angeles with offices in New York City, Milan, London, Paris and Australia. Through fearless innovation and premiere service, NuORDER is revolutionizing B2B commerce. For more information, please visit www.nuorder.com

About Brighton Park Capital

Brighton Park is a Greenwich, CT-based investment firm that specializes in software, information services, technology-enabled business services and healthcare. The firm seeks to invest in companies that provide highly innovative solutions and to partner with great management teams. Brighton Park brings purpose-built value-add capabilities that match the unique requirements of each of its companies. For more information about Brighton Park, please visit www.bpc.com.

About Imaginary Ventures

Imaginary Ventures is a venture capital firm focusing on innovations at the intersection of retail and technology. Natalie Massenet and Nick Brown launched Imaginary Ventures in 2018 to invest in the tech-enabled brands and platforms that are changing the way we live by providing best-in-class products and experiences. In December 2020, Imaginary Ventures announced their second fund of $160 million to expand their dynamic ecosystem of brands, with a continued focus in new and untapped consumer markets primed for accelerated growth, diverse founders, and technology platforms that are redefining the retail landscape. For more information about Imaginary Ventures, please visit imaginary.co.

Media Contacts

NuORDER

Parise Sellitti / Megan Thomas

PR Consulting

NuORDER@prconsulting.net

Brighton Park Capital

Emily Claffey / Julie Rudnick

Sard Verbinnen & Co

BrightonPark-SVC@sardverb.com

Imaginary Ventures

Jenna Hoops / Kyrsten Stoll

Derris

Imaginary@derris.com